Free Seller Closing Cost Calculator Online

Selling a home involves more than just handing over the keys. For homeowners, one of the most overlooked yet essential parts of the transaction is understanding the closing costs. These are the fees and charges that sellers are responsible for at the end of a real estate deal. A seller closing cost calculator is a powerful tool that provides homeowners with a clear estimate of these expenses before they finalize the sale. Whether you’re selling your house to upgrade, downsize, or relocate, knowing how much you’ll pay in closing costs helps avoid surprises and supports better financial planning. Construction Calculators offer reliable tools to help you estimate and manage these costs with ease.

What Are Seller Closing Costs?

Seller closing costs are the fees and payments a home seller must cover to complete a real estate transaction. While buyers typically cover more costs at closing, sellers also have obligations. These costs include agent commissions, title insurance, transfer taxes, escrow fees, and any outstanding utility bills or repairs agreed upon during the sale. The total amount can range from 6% to 10% of the home’s selling price, making it a substantial factor in the seller’s net proceeds. Understanding each component allows sellers to budget more accurately.

Why Use a Seller Closing Cost Calculator?

A seller closing cost calculator is designed to simplify the estimation process. Sellers can input basic details such as the home sale price, mortgage payoff, and agent commission rate. The tool then provides a breakdown of estimated expenses and the final amount the seller can expect to receive. Instead of waiting until closing day to find out, sellers gain transparency early in the process. This tool supports smarter pricing decisions, helps negotiate better terms, and prevents financial shortfalls.

Key Components of Seller Closing Costs

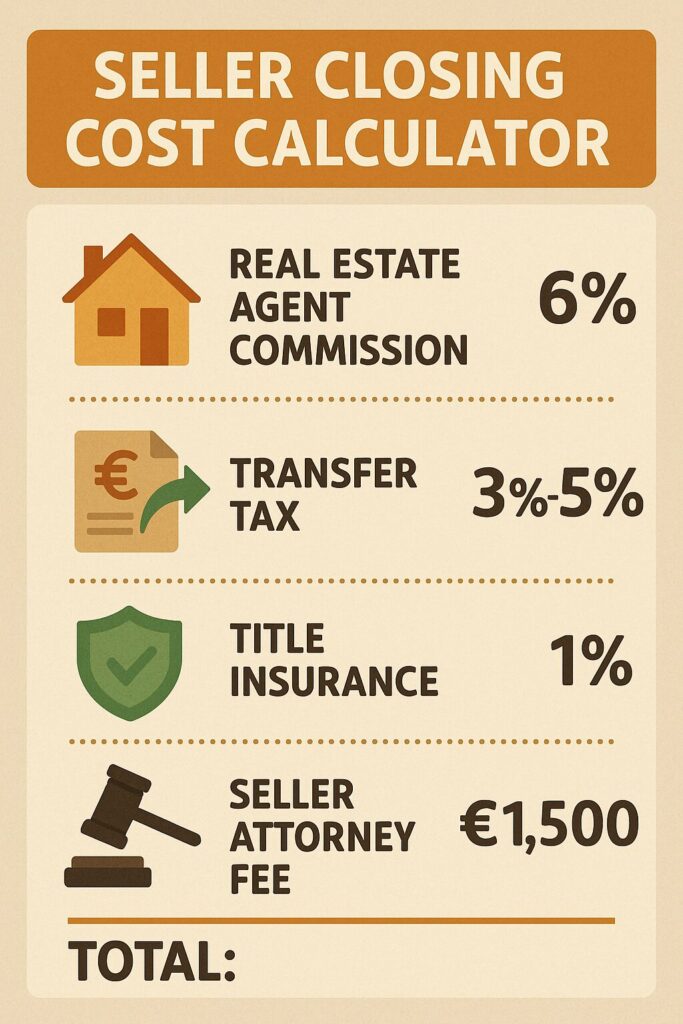

To get the most accurate results from a seller closing cost calculator, it’s essential to understand what each item means and how it’s calculated. The major components usually include:

1. Real Estate Agent Commissions

This is the largest portion of a seller’s closing costs. In most cases, the seller pays the commissions for both their listing agent and the buyer’s agent, usually totaling 5% to 6% of the home’s sale price.

2. Title Insurance Fees

Sellers often pay for the buyer’s title insurance policy to protect the buyer from potential disputes over property ownership. These costs vary by state and property value.

3. Transfer Taxes and Recording Fees

Many states and municipalities charge a transfer tax or deed recording fee. This is a one-time tax paid when the property changes ownership and can range from 0.1% to over 2% depending on location.

4. Escrow and Attorney Fees

In some states, an escrow company or real estate attorney handles the closing, and the seller may pay part of these service fees.

5. Mortgage Payoff and Prepayment Penalties

The outstanding balance of the mortgage must be paid in full at closing. Some lenders may also charge prepayment penalties if the loan is paid off early.

6. Repairs or Seller Concessions

If the buyer negotiates for repairs or closing credits after an inspection, the seller must factor these in. These amounts are agreed upon during contract negotiations.

7. Property Taxes and Utilities

Sellers are typically responsible for their share of property taxes, HOA dues, or utilities up to the closing date. These prorated charges are settled at closing.

How the Seller Closing Cost Calculator Works

Most calculators follow a simple structure. You enter the home sale price, any agent commission rates, and additional fees like taxes and title insurance. The calculator will subtract these costs and show you an estimated net profit.

For example, a home selling for $400,000 with 6% commission, $2,500 in taxes, and a $150,000 mortgage payoff might yield a net profit of around $224,500. This estimate helps sellers gauge whether it’s the right time to sell or if they need to adjust their listing price.

Sample Formula for Seller Net Proceeds

To understand the calculations more clearly, here’s a general formula: $$[

\text{Net Proceeds} = \text{Sale Price} – (\text{Agent Commissions} + \text{Taxes and Fees} + \text{Loan Payoff} + \text{Other Costs})

]$$

This formula can be used within or outside a calculator for quick manual checks.

Benefits of Using a Seller Closing Cost Calculator

Saves Time and Reduces Errors

Manual estimations can lead to missed costs or inaccurate assumptions. A calculator automates the process and reduces mistakes.

Provides Better Financial Planning

Knowing your estimated proceeds early helps with budgeting for your next home purchase or relocation expenses.

Supports Negotiation

Understanding your net amount gives you an edge during negotiations, especially when deciding how much to concede for repairs or buyer incentives.

Improves Transparency

Real estate deals come with complex paperwork. A calculator brings clarity, showing sellers where their money is going.

Helps Avoid Surprise Costs

Unexpected expenses can delay closings or even kill deals. Being informed up front helps sellers prepare and plan ahead.

When to Use the Calculator

It’s ideal to use a seller closing cost calculator at multiple stages of the home selling journey:

- Before Listing: Determine if the proceeds from the sale will cover your goals or debts.

- During Offers: Compare net proceeds across multiple offers to identify the best financial deal.

- During Negotiations: Recalculate proceeds after agreeing to any seller concessions or repairs.

- Before Closing: Double-check the estimated closing costs with final figures from your escrow or title company.

Customization Based on Location

Closing costs vary significantly by state, county, and even city. Some areas have no transfer taxes, while others have multiple layers of fees. A good seller closing cost calculator will allow you to select your location or enter local tax rates manually. This provides a more personalized and accurate result.

Understanding Net Proceeds vs. Gross Sale Price

Many first-time sellers make the mistake of equating their home’s sale price with what they’ll pocket after closing. In reality, your net proceeds are often tens of thousands of dollars less. The calculator bridges that gap between expectation and reality, providing a clear snapshot of actual earnings.

Limitations of Seller Closing Cost Calculators

While these calculators are helpful, they do have limitations. They provide estimates not exact figures. Variables such as repair costs, last-minute negotiations, or fluctuating tax rates may affect your final closing statement. Always consult your real estate agent or attorney for the most accurate numbers.

Tips for Minimizing Seller Closing Costs

There are several ways sellers can reduce their closing costs and keep more of their proceeds:

1. Negotiate Agent Commissions

Some agents are willing to accept a lower commission, especially in competitive markets or high-value transactions.

2. Shop for Title Services

Sellers can compare different title companies to find the best rates for title insurance and escrow fees.

3. Avoid Unnecessary Repairs

Only agree to repairs that are absolutely necessary or negotiate for a credit instead, which can sometimes cost less than actual work.

4. Review All Charges Carefully

Before closing, request a settlement statement and review every line item. Ask questions about any unfamiliar charges.

5. Time the Sale Wisely

Selling earlier or later in the year might save on prorated taxes or HOA dues, depending on your specific circumstances.

Closing Cost Examples by State

Here’s a brief look at how closing costs might vary by region:

- California: High agent commissions and title insurance costs can lead to average seller closing costs of 7% to 8% of the sale price.

- Florida: Transfer taxes and attorney fees can raise closing costs to 6% to 7%.

- Texas: No state transfer tax, but high property taxes can influence the total.

- New York: Often exceeds 8% due to high local transfer taxes and mandatory legal representation.

A location-aware calculator helps account for these differences.

Integrating the Calculator Into the Selling Process

Sellers should incorporate the calculator early during financial planning. It’s helpful to print out or save a copy of the results, update it after offers, and use it to compare how different sale prices or commissions affect your outcome. Having this data handy when talking to your real estate agent or lawyer makes you a more informed participant in the transaction.

Frequently Asked Questions (FAQs)

Q: Are seller closing costs tax deductible?

A: Some costs, like property taxes or mortgage interest, may be deductible. Others reduce capital gains, which can affect tax liability. Always consult a tax advisor.

Q: Do sellers ever pay the buyer’s closing costs?

A: Yes, as part of negotiations, sellers may offer to cover a portion of the buyer’s closing costs to help close the deal faster.

Q: What if I still have a mortgage on the home?

A: Your remaining mortgage balance will be deducted from your sale proceeds during closing. The calculator accounts for this if you input the correct payoff amount.

Q: Do FSBO sellers still pay closing costs?

A: Yes. Even if you don’t use an agent, you’ll still pay title fees, taxes, and possibly legal costs. You may save on commissions, though.

Q: How accurate is a closing cost calculator?

A: It provides a close estimate. The final numbers depend on your location, the buyer’s financing, and any last-minute adjustments at closing.

Final Thoughts

Selling your home is a major financial event, and knowing what to expect from closing costs is key to a smooth, stress-free process. A seller closing cost calculator offers a fast, simple way to forecast your net proceeds, break down your expenses, and plan your next move. It puts you in control of your finances and helps you make smarter decisions throughout the selling process.

If you’re planning to list your home soon, don’t wait until closing day to discover how much money you’ll actually receive. Use a seller closing cost calculator today and walk into your next deal informed, prepared, and confident. For a full picture of your financial planning, explore helpful tools like Cost Calculators, the House Construction Cost Calculator, and the Variable Cost Calculator to stay in control from sale to settlement.